BNPL at the Holidays: Convenience Now, Confusion Later

By Article Posted by Staff Contributor

The estimated reading time for this post is 844 seconds

BNPL at the Holidays: Convenience Now, Confusion Later

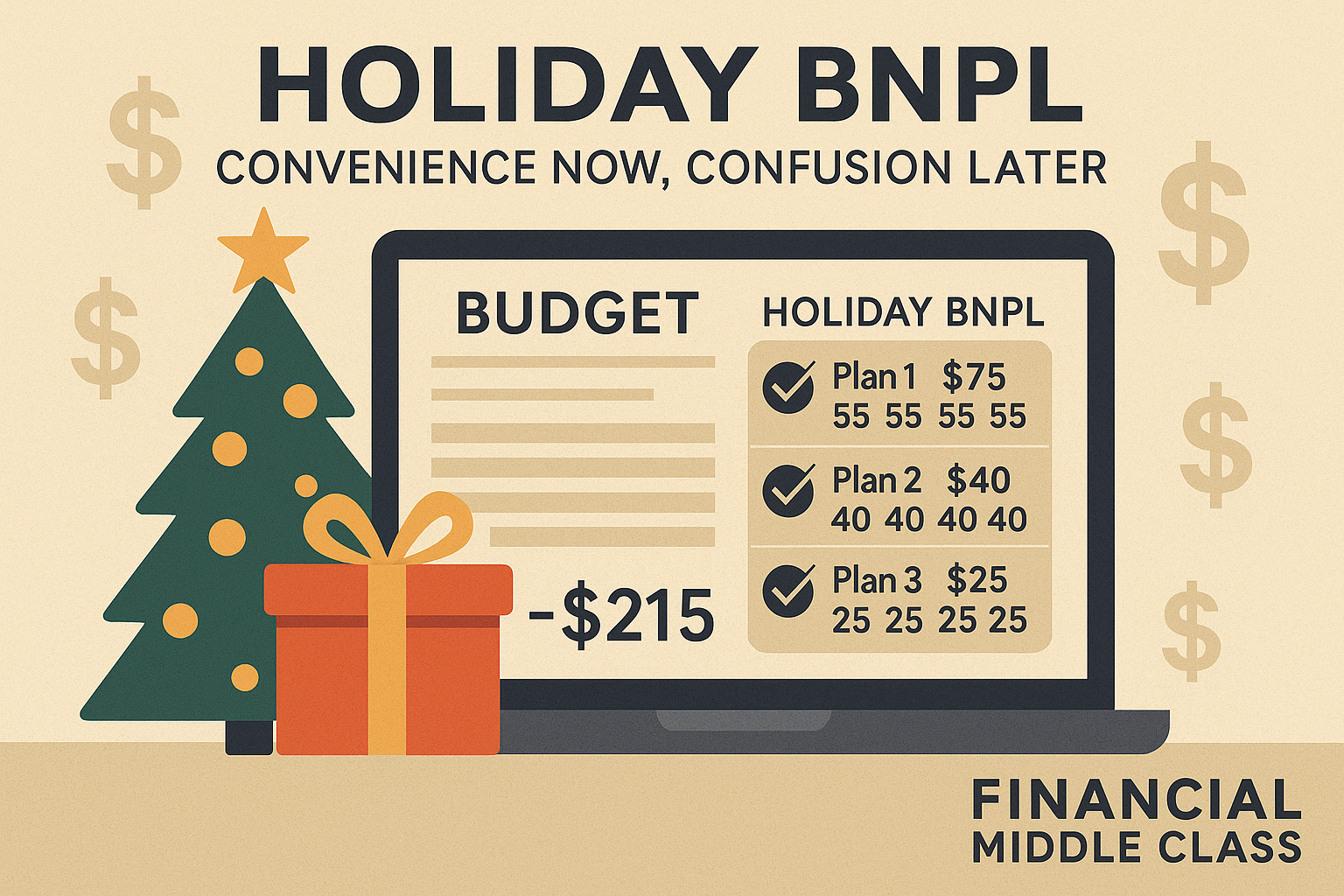

How stacked pay-in-4 plans wreck cash flow and credit—plus a simple tracking system.

Let’s pull it out of the background.

How “Pay in 4” Took Over Holiday Shopping

At its core, BNPL is simple. You split a purchase into four payments. You pay the first 25% at checkout. The other three payments hit your account every two weeks over roughly six weeks. If you pay on time, you usually pay no interest.

That structure sounds like a budgeting trick. Instead of dropping $400 today, you pay $100 every two weeks. On a tight middle-class budget, that’s appealing—especially when rent, car payments, groceries, and daycare already occupy most of your paycheck.

So it’s not shocking that millions of people use BNPL now, especially around the holidays. What used to be credit card territory—gifts, travel, “making Christmas happen”—is increasingly financed through a bunch of small “no interest” plans.

The problem isn’t one BNPL plan for a thoughtful purchase you can clearly afford. The problem is how easy it is to layer them. One for toys. One for clothes. One for décor. One for a last-minute flight. Each one feels small and justified. Together, they’re a quiet debt snowball.

Who’s Actually Using BNPL (And Why)

BNPL isn’t just some Gen Z fad. It has spread across the income and age map, but the patterns matter.

Lower- and middle-income households are more likely to use BNPL. Black and Hispanic consumers use it at higher rates than white consumers. Younger adults use it more than older ones. Women use it more than men. In other words, the tool is concentrated among people whose budgets are already fragile.

When you ask people why they use BNPL, a lot of the answers sound responsible on the surface: they want to spread out payments, they like the predictability, they want to avoid credit card interest.

But there’s another answer you can’t ignore: a big share of users say BNPL was the only way they could afford the purchase at all. That’s not convenience—that’s distress. That’s “my income and my life don’t match, so I’m using pay-in-4 as a pressure valve.”

BNPL is marketed like a sleek budgeting tool. Too often, it’s functioning like emergency financing in disguise.

The Hidden Math of Stacked Pay-in-4 Plans

The math that gets people in trouble isn’t complicated. It’s just hidden behind the “just $XX today” language.

Take two holiday shoppers. Same income, same bills, very different BNPL behavior:

| Shopper 1: One BNPL Plan | Shopper 2: Stacked BNPL Plans | |

|---|---|---|

| Holiday spending via BNPL | $400 TV | $400 TV + $250 kid gifts + $150 winter clothes = $800 total |

| Structure | Pay-in-4: $100 today, then $100 every 2 weeks (3 more times) | Three pay-in-4 plans across different apps |

| Payment per plan | $100 every 2 weeks | TV: $100; Gifts: $62.50; Clothes: $37.50 |

| Total every 2 weeks | $100 | $200 every 2 weeks |

| Duration | 6 weeks | 6–8 weeks (each plan started on a different day) |

| How it feels at checkout | “One big thing I’ve planned for.” | “Three separate, reasonable purchases I convinced myself I couldn’t pass up.” |

| How it feels in January | Mild pinch | Bank account getting hit by surprise. “Why is my balance so low?” |

Shopper 2 didn’t “spend like crazy.” They didn’t go to a luxury store or hop on a private jet. They bought stuff you might see in any middle-class house: gifts, clothes, a TV. Each decision felt okay in the moment.

But notice the key line in that comparison: $200 every 2 weeks going out the door—on top of everything else.

And here’s the kicker: BNPL due dates are tied to the day of your first purchase, not your payday. If your first payment falls on a Wednesday and you get paid on Fridays, those automatic debits can hit two days before payday, over and over again.

That’s how “no interest, no problem” becomes overdrafts, declined payments, and “I swear I had more money than this.”

When Convenience Turns into Chaos: Late Fees, Regret, and Collections

BNPL companies love to emphasize “no interest.” What they don’t spotlight is how often those neat little plans go off the rails.

A significant share of BNPL users report problems: missed payments, late fees, regret, or trouble returning items. Younger users in particular—Gen Z and younger millennials—are more likely to admit that BNPL led them to overspend and miss payments.

Here’s what you might be experiencing without fully connecting it to BNPL yet:

| What You Think BNPL Is | How BNPL Behaves in Real Life |

|---|---|

| “It’s just four payments. I can handle that.” | It’s four payments per plan, multiplied across however many plans you’ve stacked. |

| “No interest means it’s basically free.” | Late once? You can get hit with fees. Late on multiple plans? Fees stack, too. |

| “Autopay means I won’t forget.” | Autopay also means surprise withdrawals right before other bills, causing overdrafts. |

| “It’s not like a credit card; it’s smaller.” | It is credit. It’s just broken into pieces and spread across multiple apps. |

| “I’ll remember everything—I only have a few.” | A month later, you barely remember what each payment is for; you just know money is gone. |

The late fees themselves may not sound scary. A few bucks here, a few bucks there. But the real damage is multiple small late fees across multiple plans, autopay re-attempts when your balance is low, and accounts being turned over to collections if you stop paying.

This is where the “confusion later” part comes in. Most people who get burned by BNPL are not sitting around with spreadsheets and calendars. They’re juggling kids, jobs, aging parents, and everything else. The mental bandwidth to track eight different installment plans simply isn’t there.

That’s not a character flaw. It’s a design flaw.

Why BNPL Is Starting to Matter for Your Credit Score

For a long time, BNPL occupied a weird gray area. Most plans didn’t show up on your credit report. As long as you kept things vaguely under control, it felt like off-book debt.

That’s changing. New versions of credit scores are being built to pull in BNPL data—including how many BNPL loans you open and whether you pay them on time. Some BNPL companies have already started reporting certain data to the major credit bureaus. Not every lender is using these new scores yet, but the direction is clear: BNPL is moving from “side hustle credit” to real credit in the eyes of lenders.

| Old Reality | New Reality (Emerging) | |

|---|---|---|

| Regular on-time BNPL payments | Usually invisible to major credit scores | May start showing up in newer scoring models, but don’t reliably help like a prime card |

| Late BNPL payments | Often only visible if the account went to collections | Increasingly likely to be recorded and considered in some credit score calculations |

| Number of BNPL loans | Not a formal factor | Becomes a signal that someone is stretched or reliant on short-term installment credit |

| Your mental model | “It doesn’t really count as debt.” | It counts. Lenders and scoring models treat it as another form of credit exposure. |

Here’s the uncomfortable truth: BNPL users already tend to have higher credit card balances and utilization than non-users. That means the people leaning hardest on BNPL are often starting from a more fragile place. Add new scoring models that watch BNPL behavior, and the middle-class BNPL user is carrying more risk than they think.

BNPL vs Credit Card vs Cash

Three ways to pay for the same holiday purchase — and how each one hits your money differently.

Brand: Financial Middle Class

| Feature | BNPL (Pay in 4) | Credit Card (Revolving) | Cash / Debit |

|---|---|---|---|

| Up-front cost | ~25% today, rest over 6–8 weeks | Any amount up to your limit | Full cost today |

| Interest risk | Usually $0 if on-time; late fees and collections if you slip | Can be 20–30% APR if you carry a balance | None |

| Cash-flow impact | Smaller hits every 2 weeks, easy to stack and lose track | Flexible, but balances can hang around for months or years | Big hit once, then it’s done |

| Credit score impact | Growing impact in newer scores; late payments and overuse can hurt | Heavy impact: utilization and payment history drive your score | No direct impact |

| Confusion / “gotcha” risk | High: multiple apps, different dates, autopay hitting before payday | Medium: statements can be long, but it’s one bill to track | Low: you feel the cost immediately and adjust |

Middle-Class Reality Check: When BNPL Helps and When It Hurts

BNPL is not inherently evil. For some people, in some situations, it’s a useful tool. For others, it’s lighter fluid poured on an already smoldering budget.

Let’s be blunt about the difference.

| BNPL as a Tool | BNPL as a Trap | |

|---|---|---|

| Income & stability | Steady paycheck, solid emergency fund, bills current | Paycheck to paycheck, late on some bills, little or no emergency savings |

| Why you’re using it | To smooth one planned, important purchase | Because it’s “the only way” to afford multiple wants and even some needs |

| Number of active plans | One or two at a time, total monthly BNPL well under 5–7% of take-home pay | Several plans across apps; you’re not even sure how many or what the total monthly hit is |

| Tracking | Every plan written down with dates, amounts, and account used | You rely on app notifications and mystery debits to remind you |

| Emotional tone | Calm: “I could pay in full, but I’m choosing not to.” | Anxious: “I hope this all clears. I’ll figure it out later.” |

| January outcome | Slightly tighter budget, no late fees, no overdrafts | Overdrafts, scramble to cover BNPL plus regular bills, maybe a call from collections later |

BNPL Stress Test

Check every statement that feels true. Then hit “See My BNPL Zone.”

Brand: Financial Middle Class

The BNPL Holiday Tracking System (So January Doesn’t Blindside You)

You don’t need a fintech app or a fancy spreadsheet to get control back. You need one honest, ugly-truth list of every BNPL plan currently tied to your money.

At minimum, your tracking system needs to capture what you bought, who you owe, how much is coming out, when it hits your account, and which paycheck (if any) is covering it.

Use the Holiday BNPL Tracker below from Financial Middle Class to map out your plans and see the real payment schedule.

Holiday BNPL Tracker

List each pay-in-4 plan you’ve taken on this season. Then click

“Calculate BNPL Totals & Schedule” to see how much is leaving your account

every installment cycle and when each payment is due.

Brand: Financial Middle Class

| Merchant / Store | Item & For Who | BNPL Provider | Total Purchase ($) | # of Payments | Payment / Installment ($) | 1st Payment Date | Autopay? | Include? |

|---|---|---|---|---|---|---|---|---|

Total BNPL purchase amount (all included rows): $0.00

Total payment due each installment cycle (sum of all installment amounts): $0.00

Better Options Than Financing Christmas in Six Weeks

Middle-class life is set up to make you feel like you’re failing if you don’t produce a magazine-worthy holiday every year. That’s how retailers like it. That’s how BNPL companies like it. They’re selling a feeling, and they’re more than happy to bill you for that feeling six weeks at a time.

You have other options.

| BNPL-Fueled Holidays | Cash-Grounded Holidays | |

|---|---|---|

| Planning timeline | Decide in November, pay through January and February | Decide in January or February, save monthly, pay in full next December |

| Emotional state now | Relief: “I pulled it off.” | Modest pride: “We stayed honest about what we can afford.” |

| Emotional state later | Anxiety: “Why is my account so low? I forgot about these payments.” | Calm: January feels like a reset, not a hangover |

| Tool used | Multiple BNPL apps, scattered due dates | Single holiday sinking fund or separate “holiday” savings bucket |

| Middle-class story | “I kept up appearances but I’m paying for it later.” | “We drew a line that protects our future even if it looked small on Instagram.” |

A basic holiday sinking fund is boring by design: you pick an annual number that actually fits your budget, divide by 12, and automate that into a separate savings bucket. By the time next December rolls around, “holiday money” is there waiting. No apps. No four-part payment plans. No January shock.

To see whether BNPL is already eating too big a slice of your monthly income, use the guardrail calculator below.

Holiday BNPL Guardrail

Use this to see whether your total BNPL installments are staying within a healthy slice of your income.

Brand: Financial Middle Class

If you’re already deep into BNPL this year, the move isn’t to beat yourself up. The move is to track everything using the tracker above, survive this season without adding new plans, and build a tiny holiday fund starting in January—even $25 or $50 a month shifts the pressure next year.

BNPL at the holidays is sold as freedom: freedom from big one-time hits to your bank account, freedom from credit card interest. For too many middle-class households, it’s really a trade: you get convenience now, you buy confusion later.

You don’t have to swear off BNPL forever. But you do need to know exactly what it’s doing to your cash flow, your January, and soon, your credit score. The companies already have the data. The least you can do is claim it for yourself.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...