Money & Mental Bandwidth: How Holiday Stress Fuels Bad Purchases

By Article Posted by Staff Contributor

The estimated reading time for this post is 436 seconds

Money & Mental Bandwidth: How Holiday Stress Fuels Bad Purchases

Cues, traps, and a simple decision tree to buy intentionally, not emotionally.

Why Holiday Season Shrinks Your Mental Bandwidth

Most of middle-class life is already mentally heavy. The holidays just stack extra weight on top.

You’re suddenly tracking more dates, more people, more logistics, more travel, more school events, more end-of-year deadlines. Your brain isn’t just thinking about “Can I afford this?” It’s juggling:

- “Will my kid feel left out?”

- “What will my in-laws think?”

- “Is this enough?”

That constant background noise shrinks the space you have to think clearly about money.

Here’s what that looks like in real life:

| Situation | What’s Really Happening In Your Head | How It Shows Up At the Register |

|---|---|---|

| End-of-year work crunch | You’re exhausted and behind on email | You buy whatever the first ad suggests so you can cross “gift” off the list |

| Social media gift posts | You’re comparing your real life to everybody else’s highlight reel | You add “just one more thing” so your holidays look “normal” |

| School / work gift exchanges | You don’t want your kid or yourself to look cheap | You bump the budget up at the last minute without a real ceiling |

| Family history / old guilt | You’re still carrying old stories about being “poor” or “the broke one” | You overspend to prove (to yourself or them) that you’re “doing better” |

None of this is about math. It’s about pressure. And pressure plus low mental bandwidth is where bad purchases live.

How Retailers Weaponize Your Tired Brain

Holiday marketing is not subtle. It’s not supposed to be. It’s engineered to slice right through whatever tiny bit of willpower you have left at 9:47 p.m. on a Tuesday.

Think about the cues you’re bombarded with:

- “One day only.”

- “Only 3 left.”

- “Order by midnight for Christmas delivery.”

- “Give them the holiday they deserve.”

You’re not being asked, “Does this item fit your budget and align with your values?” You’re being pushed toward, “If you don’t buy this now, you’re failing.”

Here’s how the cues line up against your mental bandwidth:

| Cue / Tactic | Emotional Button It Pushes | What It Does To Your Thinking |

|---|---|---|

| Countdown timers | Fear of missing out, scarcity | Creates fake urgency; you skip the “Do I need this?” step |

| “Only X left in stock” notices | Competition, panic | You prioritize speed over price or fit |

| “People like you also bought…” | Belonging, comparison | You anchor to what others spend, not what you can afford |

| “Buy now, pay later” buttons | Relief, avoidance | You focus on the first payment, not the full cost |

| Heart-tugging family imagery | Guilt, nostalgia | You try to buy a feeling instead of planning for it |

All of that lands on a brain that’s already juggling work, kids, bills, and end-of-year goals. Of course you click. That’s the point.

The goal isn’t to out-willpower a billion dollars of ad science. The goal is to slow the moment down just enough to let your wiser self get a vote.

That’s where a decision tree comes in.

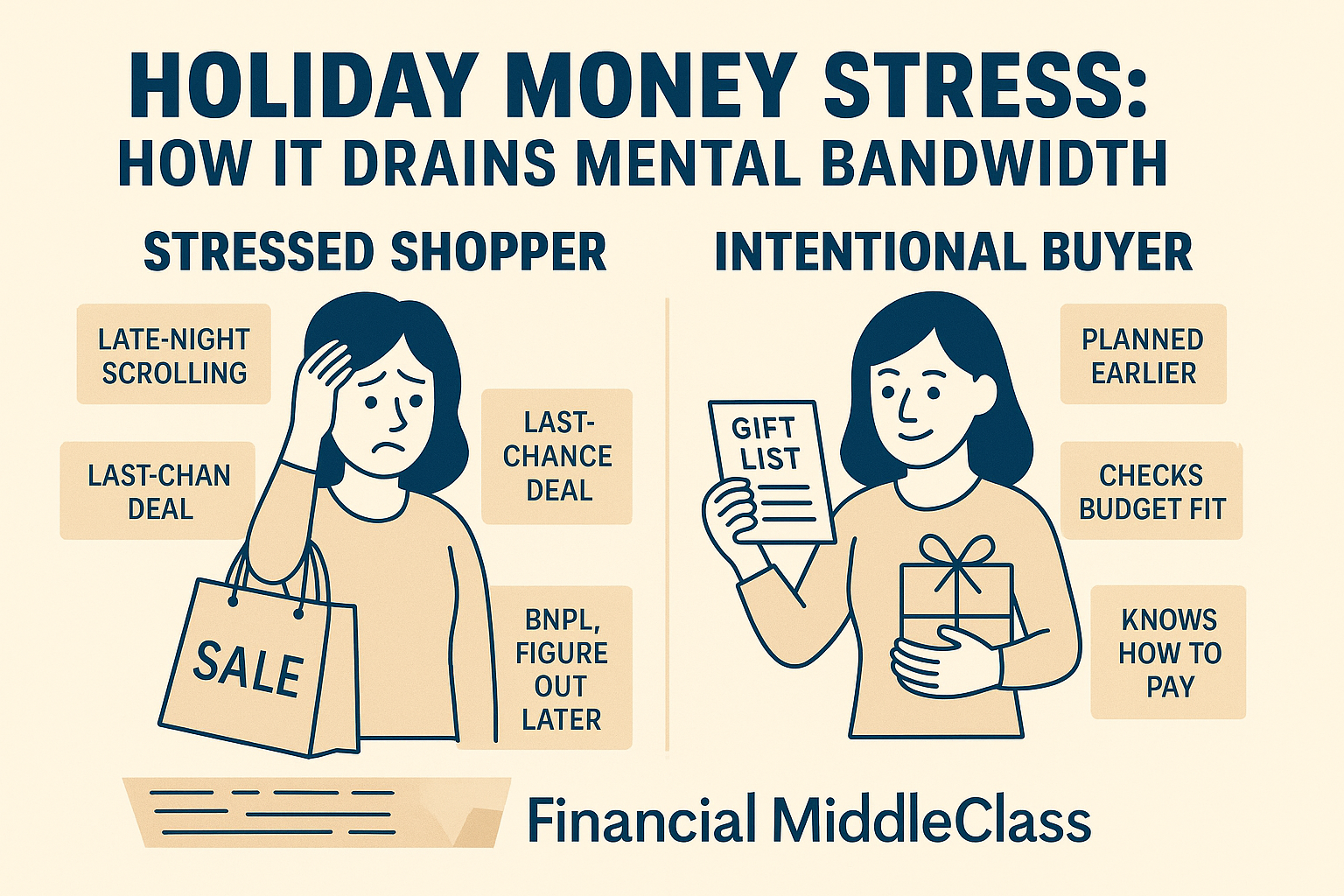

Emotional Purchases vs Intentional Purchases (Side by Side)

You can’t stop every emotional purchase. But you can learn to spot the pattern sooner.

Here’s a simple comparison to keep in your back pocket:

| Emotional Purchase (Holiday Mode) | Intentional Purchase (Holiday On Purpose) | |

|---|---|---|

| Timing | Late at night, during a rush, scrolling while stressed | Planned in a calmer moment, ideally earlier in the season |

| Trigger | A sale email, a post, a “last chance” pop-up | A gift list you built, a real need, or a planned tradition |

| Primary feeling | Guilt, anxiety, fear of missing out, envy | Warmth, satisfaction, alignment with your priorities |

| Question you ask | “What will they think if I don’t?” | “Does this fit my budget and what I value?” |

| Payment decision | Click first, figure it out later (BNPL, card, whatever clears) | You know exactly how you’ll pay and what you’ll say no to instead |

| Next-day reaction | “Why did I buy that? Can I even remember what’s in that order?” | “That was a good call. I still feel okay seeing that charge.” |

If you read that table and think, “I’ve been living in the left column,” you’re not alone. Most people are during December. The win is not to never feel holiday emotions. The win is to channel them through a better filter.

A Simple Holiday Purchase Decision Tree (So You Don’t Have To Think That Hard)

When your mental bandwidth is low, you need fewer choices, not more.

Here’s a simple decision tree you can run almost any holiday purchase through. Think of it as your minimum standard, not a complicated budget tool.

We’ll frame it as a series of questions with “Yes/No → Do this” so you can see it at a glance:

| Question | If YES | If NO |

|---|---|---|

| 1. Is this already on my written gift/holiday list? | Go to Q2. | Pause. Add it to the list first and wait 24 hours before buying. |

| 2. Do I know what I’m cutting or delaying to afford it? | Go to Q3. | Decide what you’ll say no to (another gift, a dinner out, etc.) before moving forward. |

| 3. Can I pay in full today without touching rent, bills, or debt payments? | Consider buying in full if the price is fair. | Go to Q4. |

| 4. If I use BNPL/credit, will the total payments stay under my guardrail (e.g., 5–7% of take-home)? | Only proceed if you can see the actual payment schedule and still feel calm. | Treat the “Pay in 4” button as a red light. Close the tab or scale the purchase down. |

| 5. Am I buying mostly to avoid guilt, comparison, or awkwardness? | Consider a smaller version of the same idea or a non-money solution (note, time, call). | If the answer was no at every step and the numbers still work, you likely have a solid yes. |

You don’t have to ask these questions out loud every time. The goal is that after walking through it a few times, your brain recognizes the red flags more quickly:

- “This isn’t on the list.”

- “I haven’t decided what I’m giving up.”

- “I’m just trying not to feel guilty.”

Every time you notice one of those, you’ve already won. You’ve moved the purchase from autopilot to awareness.

Pre-Loading Your Brain: Scripts and Defaults That Save You in the Moment

Trying to invent discipline in the checkout line is a losing game. You need defaults and scripts set up before you’re tired.

A few examples of how you can pre-load your thinking:

| Area | Default You Set Before December | How It Helps In the Moment |

|---|---|---|

| Gift budget | A total number and per-person caps you’ve written down | Makes “Is this on my list?” and “Does it fit?” answerable fast |

| Payment method | Decide: “Cash/debit only” or “This one card; no BNPL” | Removes the “how to pay” decision entirely |

| “Too expensive” script | “This is a beautiful gift, but it’s not in my range this year.” | Gives you language to walk away without spiraling in shame |

| Social pressure | “Our family is doing smaller gifts and more time together this year.” | Pre-sets the expectation before you’re on the spot |

You’re not trying to remember everything in the moment. You’re trying to remember one or two rules you already decided when your head was clearer.

Protecting Your Mental Bandwidth Without Becoming the Holiday Grinch

Protecting your mental bandwidth doesn’t mean killing the vibe. It means being honest about what you actually have to give: money, time, and emotional energy.

Think about the tradeoffs like

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...