Guiding Your Financial Journey: Smart Strategies for Effective Wealth Management

Mastering the complexities of your personal finances is an indispensable life skill in today’s fast-paced, unpredictable economic landscape.

Navigating this journey successfully requires understanding and skillfully managing your financial resources, thus highlighting the crucial role of money management in achieving financial security and freedom.

The Foundations of Effective Money Management

Smart money management transcends the confines of timely bill payments and earning a high salary. It’s about making well-informed, strategic decisions about your earnings and savings. This involves mastering budgeting, investing, retirement planning, insurance, taxes, and maintaining a thorough understanding of the broader financial market.

The road to successful money management begins with setting practical financial goals.

Remember, personal finance doesn’t adopt a one-size-fits-all approach – everyone’s financial circumstances and aspirations vary. For some, the ultimate goal could be an early retirement, while others may strive to purchase a dream home or fund a child’s higher education.

Budgeting: Your Financial Blueprint

Budgeting is the cornerstone of financial management. It’s the process of mapping out your income and expenses to gain insights into your spending patterns and how to optimize your resource allocation.

Creating a budget may seem intimidating, but with a plethora of tools and applications available today, the task has become considerably simpler. As you draft your budget, be sure to account for both fixed and variable expenses and anticipate potential future costs.

Once you have a budget, adherence is critical – discipline is indeed the backbone of budgeting. However, keep in mind that flexibility is equally important. Changes in income, expenses, or personal circumstances might necessitate revisions to your budget.

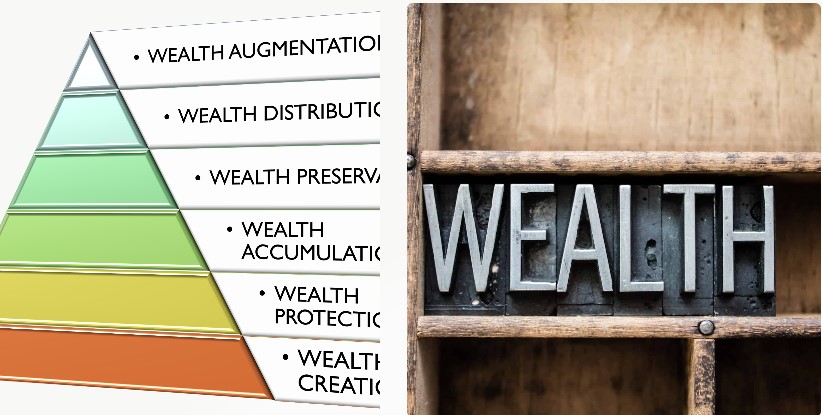

Investing: The Route to Wealth Accumulation

Investing is an essential tool for wealth generation. Prudent investments can augment your wealth, providing a safety net for unexpected expenses and ensuring a comfortable post-retirement life.

Investing necessitates an understanding of various investment vehicles like stocks, bonds, mutual funds, real estate, among others. It also requires a grasp of the potential risks and rewards associated with each.

Diversification – spreading your investments across different asset classes – is a smart approach to minimize risk while maximizing returns. However, it’s crucial that your investment strategies align with your financial goals and risk tolerance.

Remember, patience is a virtue in investing. Wealth accumulation is often a gradual process that rewards long-term investing.

Retirement Planning: Safeguarding Your Future

Regardless of your age, it’s never too early to begin planning for retirement. The sooner you start, the more time your money has to grow through the magic of compound interest.

Consider leveraging tax-advantaged retirement plans like 401(k)s or individual retirement accounts (IRAs) to bolster your wealth accumulation.

Understanding Insurance and Taxes

Insurance is a crucial component of a comprehensive financial plan, serving as a safety net for unexpected life events. Meanwhile, understanding taxes can help you optimize your income and investments. Familiarity with tax laws and potential deductions can save you a significant sum annually.

Utilizing Technology in Finance

Finally, embrace the power of the multitude of financial tools and apps available today. These platforms can simplify tasks like budgeting and investing, provide real-time insights into your financial status, and offer personalized advice to enhance your financial acumen.

Closing Remarks

Navigating the journey of smart money management is a lifelong endeavor with the potential to lead to financial freedom.

Understanding the fundamentals of financial planning, budgeting, investing, retirement planning, insurance, taxes, and the effective use of technology can empower you to take control of your financial destiny.

Financial literacy isn’t acquired overnight – it’s a constant process of learning, adjustment, and evolution. As your life circumstances change, so should your financial strategies.

With patience, discipline, and the right knowledge, you’ll be well-equipped to traverse the complex terrain of personal finance.

Though the journey of smart money management can seem daunting at first, the rewards are truly worth the effort. So why hesitate? Kickstart your journey to financial freedom today!