Trending Now :

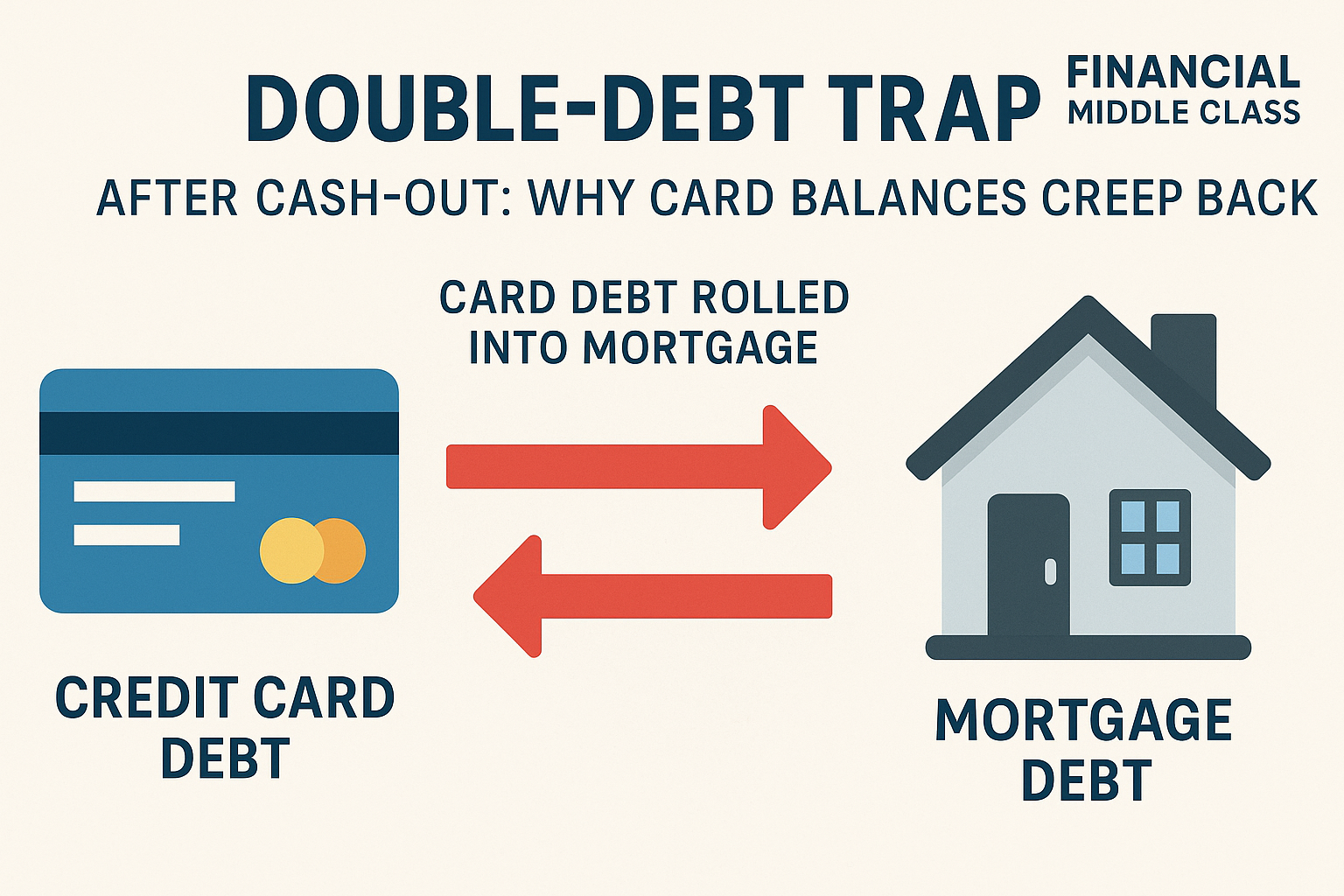

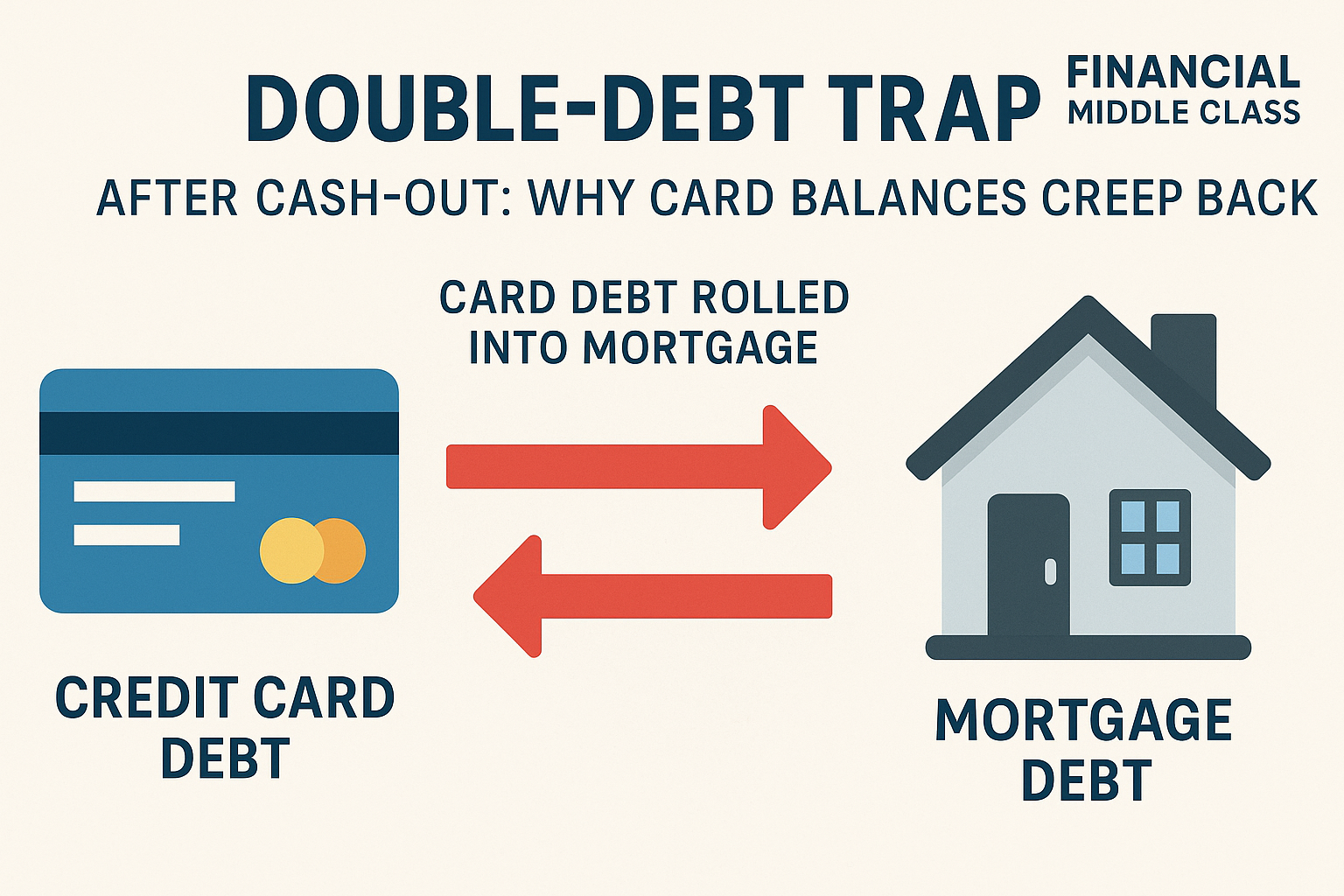

Home » Debt » Double-Debt Trap After Cash-Out The Double-Debt Trap After Cash-Out: Why Card Balances Creep Back Rolling card debt into your mortgage sounds smart,...

Mortgage rates barely slipped—call it three-quarters of a point from recent highs—and yet homeowners rushed to cash-out refis like it’s 2005 with granite countertops on the...

When homeowners need funds for various purposes, such as home improvements, debt consolidation, or covering unexpected expenses, they often consider tapping into their home’s equity. Cash-out...

While making payments on your residence, you are going to build equity, and you will be able to tap that equity, which can be turned into...

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...