Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use this 60-second framework—read now.

Skip to main content Holiday Debt Detox: What to Do in January A 30-day plan to wipe balances, fix your budget, and reset habits after the...

Try a 30-day No-Spend January that actually works—rules, exceptions, and a plan for the savings. Start your January Freeze today.

Drowning in credit card interest? See if a 2026 consolidation loan helps—or hurts. Run the 5-question test before you sign.

What your credit limit really signals—and how to use it. Learn the smart move for middle-class money. Read now.

Trailing interest can quietly cost you thousands in credit card charges—learn how to spot it, stop it, and keep more money in your pocket.

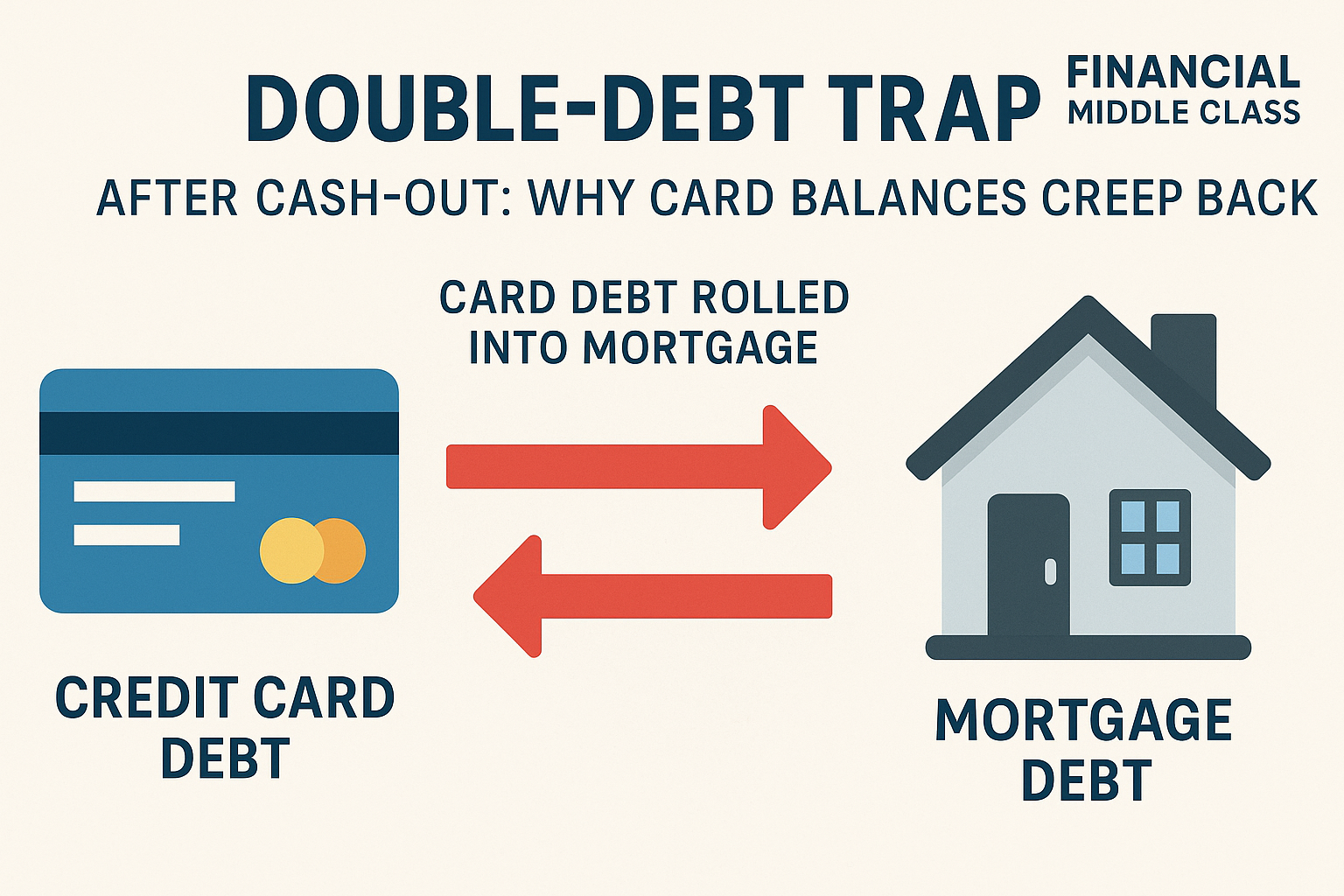

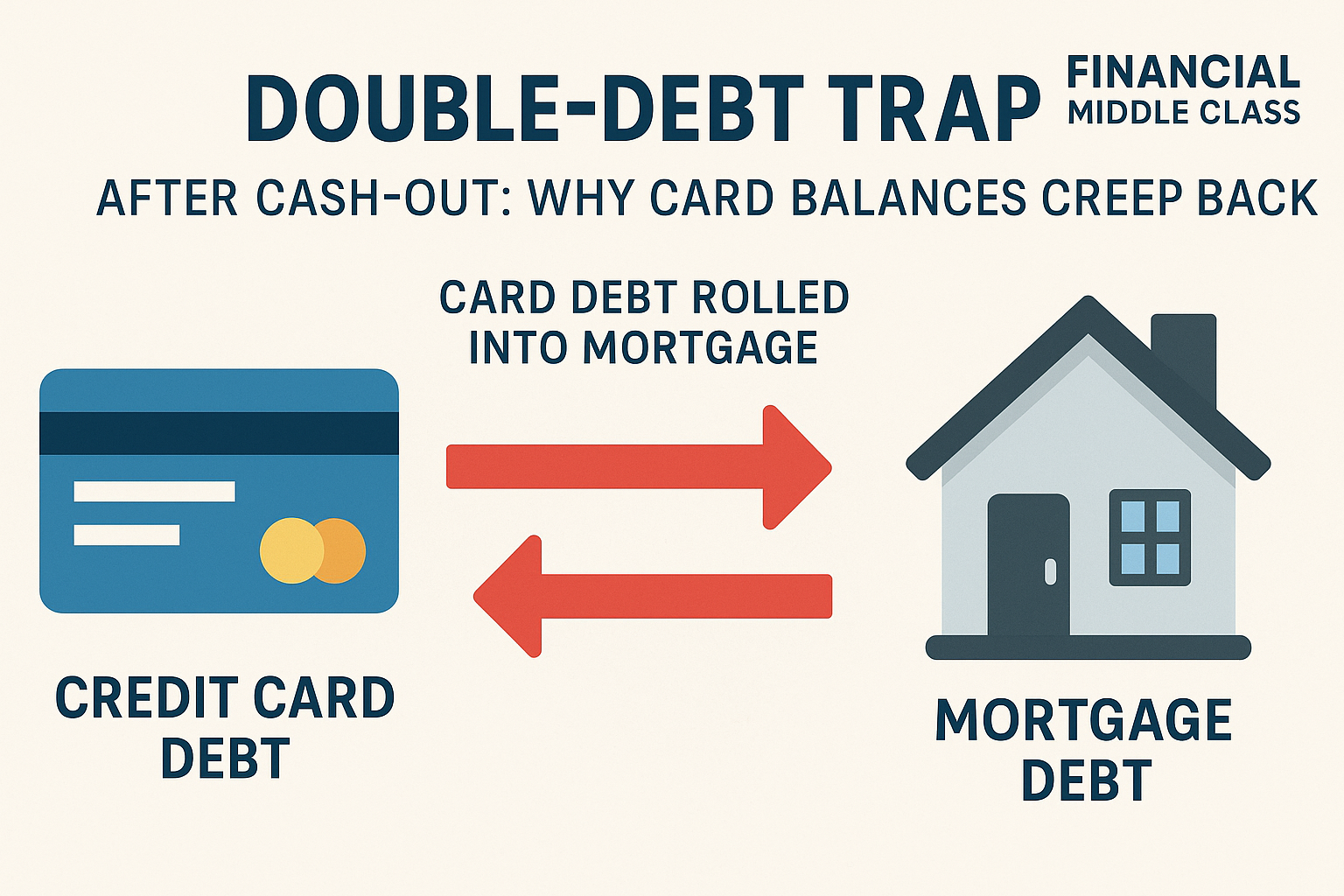

Home » Debt » Double-Debt Trap After Cash-Out The Double-Debt Trap After Cash-Out: Why Card Balances Creep Back Rolling card debt into your mortgage sounds smart,...

You already know the punchline: they cost more than we planned—financially and emotionally. Between Halloween, Thanksgiving, Christmas, and everything in between, too many middle-class families overspend,...

Mounting Credit Card Debt Sends Shockwaves Through U.S. Economy In a sobering financial milestone, Americans now grapple with an unsettling reality: their collective credit card debt...

Rising Credit Card Debt in the U.S.: Causes, Consequences, and Strategies Credit card debt in the United States has reached alarming levels, causing concerns among lenders...