The lingering shadows of the Gilded Age stretch into the present, casting a long silhouette over America’s economic landscape. Families like the Waltons, the Mars clan, and the Cargill-MacMillans stand as pillars of enduring wealth, their fortunes built over decades and, in some cases, centuries. These dynasties have accumulated vast resources and mastered the art of preserving and growing their wealth through generations.

In stark contrast, the nouveau riche emerged as their families’ first beacons of affluence. They are pioneers, breaking barriers that confined previous generations to financial modesty. With newfound wealth comes newfound responsibility—not just for themselves but for a web of family members who look to them for support. Education fees for nieces and nephews, medical bills for aging parents, startup capital for siblings’ ventures—the financial obligations extend far beyond their personal needs.

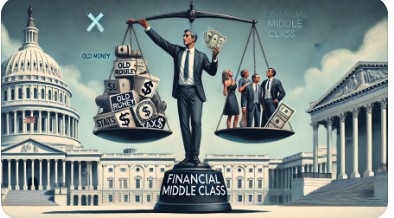

Yet, when tax season arrives, the U.S. tax code makes little distinction between old money and new wealth. Both are subject to the same income tax rates, estate taxes, and capital gains levies. On paper, it appears equitable; in practice, the burden weighs heavier on the shoulders of the nouveau riche.

Old-money families have long benefited from sophisticated tax planning strategies. They employ teams of accountants and lawyers adept at navigating loopholes, setting up trusts, and leveraging offshore accounts to minimize tax liabilities. Their wealth is often tied up in assets that appreciate over time—real estate, stocks, art collections—rather than straightforward, readily taxable income.

The nouveau riche, however, may need access to such intricate financial maneuvering. Their wealth is frequently more liquid and transparent, derived from salaries, bonuses, or the sale of a business. Without the generational knowledge or advisory networks to shield their assets, they face the full brunt of tax obligations. The result is a disproportionate financial strain that needs to account for their additional responsibilities.

Moreover, the societal expectations placed upon the newly wealthy compound their challenges. There’s an implicit pressure to elevate their lifestyle—bigger homes, luxury cars, private schools for their children—which can quickly erode their financial base. Coupled with substantial tax bills and familial support, the facade of wealth can mask an underlying precariousness.

This disparity raises critical questions about the fairness of the tax system. Is it equitable to treat all high earners identically without considering their unique circumstances? Should tax policy account for the nuances between inherited wealth and self-made affluence, primarily when the latter supports broader familial structures?

Reforming the tax code to address these issues is a complex task. It delves into complex debates about economic justice, wealth distribution, and the role of government in leveling the playing field. Some may argue for progressive taxation that intensifies with the scale of wealth, mainly targeting assets sheltered across generations. Others might advocate for tax incentives recognizing and supporting the financial burdens shouldered by the nouveau riche in uplifting their families.

In the meantime, the nouveau riche navigates a tightrope, balancing personal aspirations with external obligations and hefty tax responsibilities. Their stories highlight a paradox within the American dream: that achieving financial success doesn’t always equate to financial security. As they strive to solidify their place in the upper echelons of wealth, they carry not just the weight of their fortunes but also the hopes and needs of those who depend on them.

The dialogue about taxation and wealth is as old as the republic itself. Yet, as economic landscapes shift and new fortunes emerge, it’s imperative to revisit and reassess how policies impact different segments of society. Recognizing the unique challenges faced by the nouveau riche is a step toward a more nuanced and equitable approach—one that honors both the legacy of old money and the aspirations of new wealth.