The Affordability Pivot: Can Trump’s New Promises Actually Lower the Middle-Class Bill?

By Article Posted by Staff Contributor

The estimated reading time for this post is 690 seconds

People love to argue about politics like it’s a sport. But the middle class doesn’t experience politics that way. You experience it like a receipt.

You don’t wake up thinking, “What is my ideology today?” You wake up thinking, “Why is this bill higher?” And, “How did I make decent money and still feel broke?”

That’s the backdrop to Trump’s latest pivot. After downplaying affordability concerns in the past, he’s now leaning into it—hard. The new pitch is basically: I’m going to make life cheaper. Housing. Credit cards. Gas. Even checks for everyday Americans, funded by tariffs.

It sounds like the kind of agenda that should translate into immediate relief. It also sounds like the kind of agenda where the fine print matters more than the headline.

Because “affordability” is a slippery word. Sometimes it means lowering prices. Sometimes it means lowering monthly payments. Sometimes it means giving people money to survive higher prices. And sometimes it means nothing at all except that someone noticed voters are mad.

So let’s treat this like grown folks. Not like fans. Not like haters. Like adults trying to run a household.

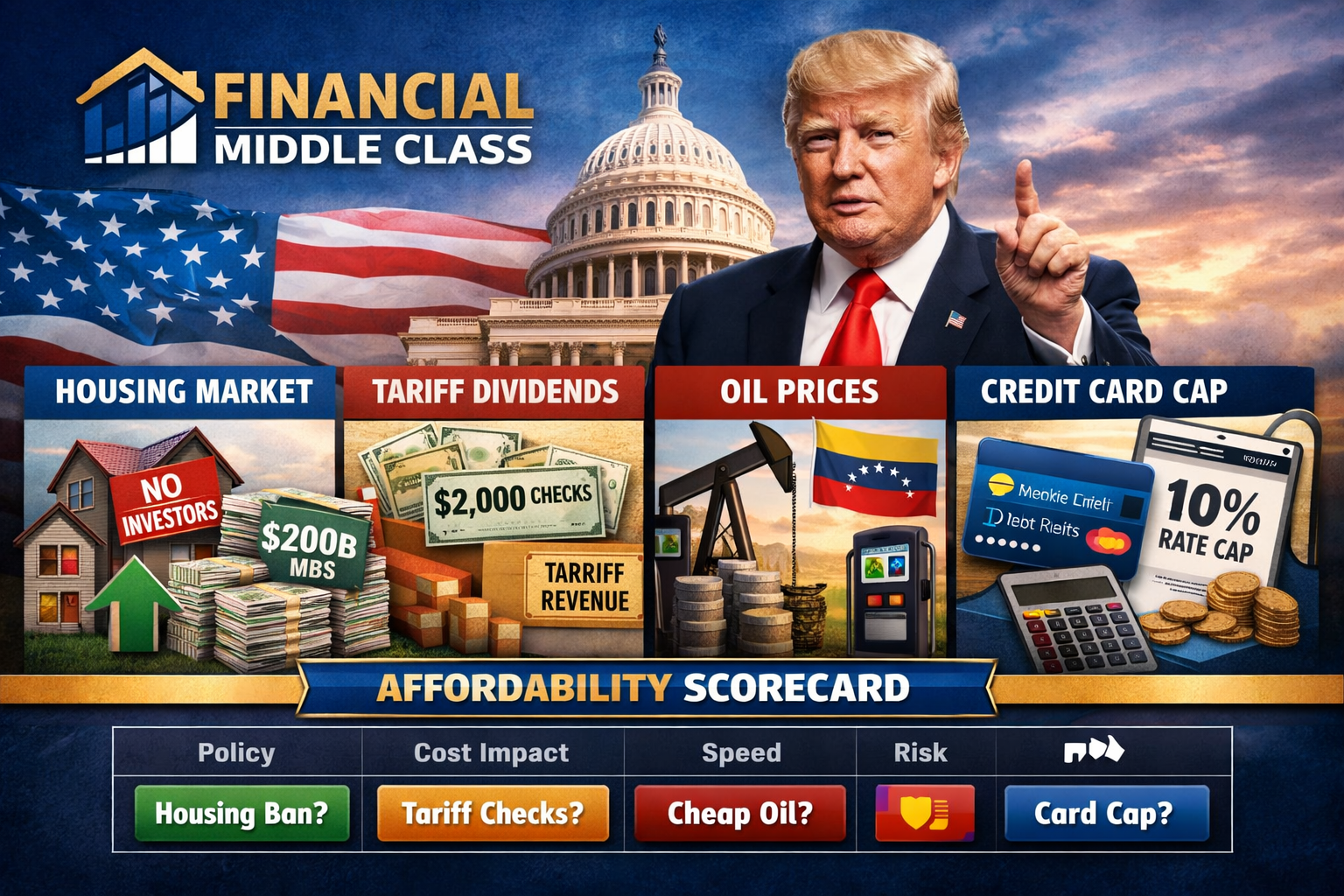

Trump’s proposals include: banning large investors from buying single-family homes, pushing Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds to lower mortgage rates, using tariff revenue to cut most Americans checks of at least $2,000, a plan tied to Venezuela’s oil sector meant to lower oil prices, and a 10% cap on credit-card interest rates that would require Congress.

They are five different levers. Some could help. Some could backfire. Some might be dead on arrival. And one or two might be “helpful” in a way that still doesn’t solve the problem it claims to solve.

The problem with affordability politics

Affordability isn’t one problem. It’s a stack of them.

Housing costs are crushing people even when they can technically “afford” the payment, because the payment eats their flexibility. Credit cards are a quiet emergency tax when wages don’t keep up. Gas and groceries are the kind of costs you can’t refinance and can’t negotiate with. And a lot of families aren’t spiraling because they’re reckless—they’re spiraling because everything got expensive at once and nothing got meaningfully cheaper.

That’s why politicians love affordability. It’s a clean word for a messy reality.

But a messy reality won’t be fixed by clean messaging.

If a proposal lowers mortgage rates but pushes home prices higher, you didn’t win. If a proposal mails you a check but raises the cost of everyday goods to fund it, you didn’t win. If a proposal caps credit-card APRs but causes banks to tighten credit and add fees, you didn’t win—you just got a different kind of problem.

The only honest way to judge these ideas is to walk through how they work, who they actually help, and what kind of resistance they run into.

1) Banning large investors from buying single-family homes

This is the one that gets applause. It’s visual. It’s easy to grasp. Families should buy homes, not corporations.

And yes—investors buy houses. In some markets, they buy a lot of them. It can change neighborhoods. It can distort starter homes. It can turn “for sale” signs into “for rent” signs for the next decade.

But if you zoom out to the national scale, the story gets less cinematic.

Large institutional investors aren’t the majority of homebuyers nationwide, and they aren’t the whole reason prices are high. Evidence cited in major reporting and government analysis suggests big institutional owners represent a relatively small share of single-family rentals nationally, even if they’re influential in certain places.

The bigger reason housing is unaffordable is simple and maddening: there are not enough homes.

Freddie Mac has estimated the U.S. housing shortage in the millions, reflecting a gap between household formation and housing supply. When supply is that tight, everyone fights harder. When everyone fights harder, prices climb. That’s not ideology. That’s math.

A ban on large investors could help at the margin in some zip codes. But nationally, it’s not the kind of policy that makes a middle-class household say, “Finally, the market is sane again.” Unless it’s paired with a real supply strategy—build more, speed up approvals, reduce bottlenecks—it’s a pressure valve, not a fix.

The other issue is enforcement. What counts as “large”? How do you stop a firm from buying through affiliates? How do you keep the policy from simply pushing investor capital into different channels that still compete with ordinary buyers?

This proposal might still be worth doing, depending on how it’s written. But it is not a housing solution by itself. It’s a housing gesture unless it sits on top of bigger structural moves.

2) The $200 billion mortgage-bond push to lower mortgage rates

This is the most “inside baseball” proposal, which is exactly why it’s dangerous. The technical stuff is where governments can shift markets without people noticing until it’s done.

The basic concept is simple enough: if government-backed mortgage entities buy a lot of mortgage-backed securities, they can increase demand for those bonds. Higher demand tends to lower yields. Lower yields can translate into slightly lower mortgage rates for borrowers. Reporting on the plan has noted that analysts expect the effect to be modest, not transformative.

The question for the middle class is what “modest” means in real life.

Here’s a clean example.

| Mortgage example | Loan | Rate | Monthly P&I (approx.) |

|---|---|---|---|

| Baseline | $400,000 | 6.50% | $2,528 |

| After a small rate nudge | $400,000 | 6.35% | $2,489 |

That’s about $39 a month. Useful. Not a miracle.

Now here’s the part people don’t want to hear: in a supply-constrained market, lowering rates can push prices higher because buyers can afford to bid more. That means the rate relief can get absorbed into the purchase price. Moody’s Analytics’ Mark Zandi has warned about this kind of backfire dynamic.

So what you could end up with is a policy that makes the monthly payment slightly easier for some buyers, while raising prices enough to cancel out the benefit for others. It becomes a game of timing—who buys before the price response and who buys after.

There’s also the question of authority and execution. Fannie Mae and Freddie Mac sit under FHFA conservatorship; the agency’s role in overseeing the enterprises is a key part of how these moves would be structured. That’s not a moral argument. It’s an operational fact: this kind of plan lives and dies by implementation and market response, not by speeches.

So yes, this could shave rates a bit. But even in the best case, it’s not a housing affordability revolution. It’s a demand-side tweak in a supply problem.

3) The “tariff dividend” checks: $2,000 to most Americans

This one is the most seductive. People understand checks. You don’t need an economics degree to know what $2,000 does to your month.

The claim is that tariff revenue could fund payments of at least $2,000 to most Americans.

But two questions matter immediately: does the revenue cover it, and what does the tariff policy do to prices?

On coverage, independent analysts have raised doubts that the numbers line up at scale. The Committee for a Responsible Federal Budget has estimated that a broad $2,000 dividend structure could run into the hundreds of billions annually—well beyond what tariffs are likely to reliably generate at many proposed levels.

On price effects, the evidence is not friendly to the idea that tariffs are “free money.” Tariffs are taxes on imports. And research from institutions like the CBO and the Federal Reserve has found that tariffs can raise domestic prices through pass-through, affecting consumers and businesses.

So you can end up in a situation where you’re getting a check in one hand while paying higher prices with the other. The check might still help—especially for households living close to the edge. But it changes the nature of the promise. It’s not “I made things cheaper.” It’s “I taxed one stream of commerce and redistributed some of it back.”

Here’s the comparison in plain terms.

| What you feel | What you might also feel |

|---|---|

| A $2,000 check improves cashflow | Higher prices on tariff-exposed goods as costs pass through |

| Relief for bills and debt | A budget gap if payments exceed tariff revenue |

This is not automatically a bad idea. But it’s not “affordability” the way people mean it. It’s fiscal policy framed as affordability, and the middle class deserves the truth about that.

4) Venezuela oil: the gas-price promise

Gas prices are emotional. People can ignore a lot of policy until the sign at the pump reminds them what “inflation” feels like.

Trump has been tied in reporting to plans involving Venezuela’s oil industry aimed at lowering oil prices.

The problem is that oil is a global market with a lot of moving parts. Even if a policy increases supply, it may take time. And Venezuela’s oil sector has structural constraints—investment needs, infrastructure issues, operational degradation—that limit how quickly production can surge.

Energy affordability is also shaped by broader global supply and demand. EIA-related reporting has described conditions where global supply outpaces demand and prices trend down, which means you might get lower prices anyway—without needing a bold geopolitical strategy.

So could this plan help? Possibly, if it meaningfully increases supply. But it’s not a knob you turn and instantly lower gas. It’s a geopolitical gamble packaged as a household discount.

If you’re a middle-class household building a budget, you don’t count on this. You treat it as a “maybe.”

5) A 10% cap on credit-card interest rates

This is the most direct proposal on the list. It hits a real bill people pay every month.

The average credit-card interest rate has been around 20% in recent reporting based on Federal Reserve data. A cap at 10% would be a meaningful shift for households carrying balances.

Here’s what that means, stripped down to the essentials.

| Revolving debt example | Balance | APR | Rough annual interest |

|---|---|---|---|

| Today | $10,000 | ~20.97% | ~$2,097 |

| Under a 10% cap | $10,000 | 10% | ~$1,000 |

That’s real relief.

But it comes with the big tradeoff: lenders don’t stop pricing risk—they stop lending to people who don’t fit the new model. Or they shift the business into fees, lower limits, fewer approvals, and fewer perks. Reuters reported banking-industry pushback and warnings about reduced access to credit and economic effects; congressional leadership has also pointed out it would require legislation.

A cap could still be worth pursuing. But the middle-class version needs to be honest: if it passes, it should come with rules that limit fee games and protect access so the policy doesn’t become “cheap credit for people who already had it.”

The middle-class verdict: what actually helps, what’s mostly noise

If you’re looking for a clean conclusion, politics won’t give you one. Reality is mixed.

The credit-card APR cap, if enacted, is the clearest path to lowering a real middle-class bill. It’s simple, direct, and felt immediately—assuming issuers don’t dodge it with fees and restrictions.

The mortgage-bond plan can shave rates at the margin, but it’s not a housing fix. In a shortage, demand-side tweaks can inflate prices. The relief can be real but small, and sometimes it’s temporary.

The investor ban is emotionally satisfying and may help in certain markets, but it’s not a national affordability reset without a housing-supply agenda behind it.

The tariff dividend is a cashflow program with a complicated funding story and real inflation/price pass-through risks. It may help some households, but it’s not “making things cheaper.” It’s creating a new loop.

The Venezuela oil plan is the most uncertain. It might nudge energy prices if supply rises. It’s also slow, geopolitical, and not a lever you can rely on for immediate household relief.

Here’s the scorecard in one place.

| Policy | Likely impact | How fast | Feels like relief? | Biggest risk |

|---|---|---|---|---|

| Investor ban | Small nationally | Medium | Sometimes, locally | Doesn’t fix supply |

| $200B MBS buys | Small-to-moderate | Short/medium | A little | Higher prices offset lower rates |

| Tariff checks | Depends | Short | Yes, but… | Higher prices + funding gap |

| Venezuela oil | Uncertain | Medium/long | Maybe | Timeline + geopolitics |

| 10% APR cap | Meaningful for revolvers | Short | Yes | Credit access tightens |

Related Reads:

APR vs. APY, Revolving Debt, and the Interest Games Lenders Play

What credit score do you need to buy a house in 2026?

What Does Your Credit Limit Say About Your Financial Self?

What would actually make life cheaper

If you want affordability that lasts, you end up in the boring place again: supply.

You build more housing. You reduce bottlenecks. You treat zoning and permitting like national economic policy, not local trivia. Because you can’t “finance” your way out of a shortage forever, and you can’t “ban” your way out of a shortage either.

You deal with debt costs in a way that doesn’t punish people who are already fragile. You push competition and transparency so borrowers aren’t trapped in expensive products by default.

And you stop pretending affordability is one magic lever. It isn’t.

The reason the middle class is skeptical isn’t that it hates policy. It’s that it has been trained, year after year, to watch big announcements turn into small changes. And small changes don’t matter when the math is tight.

The real test of this affordability pivot won’t be whether it sounds good. It’ll be whether the people at the kitchen table feel something they haven’t felt in a long time.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...