Common First-time Homebuyer Mistakes That Quietly Wreck Your Budget

By Article Posted by Staff Contributor

The estimated reading time for this post is 131 seconds

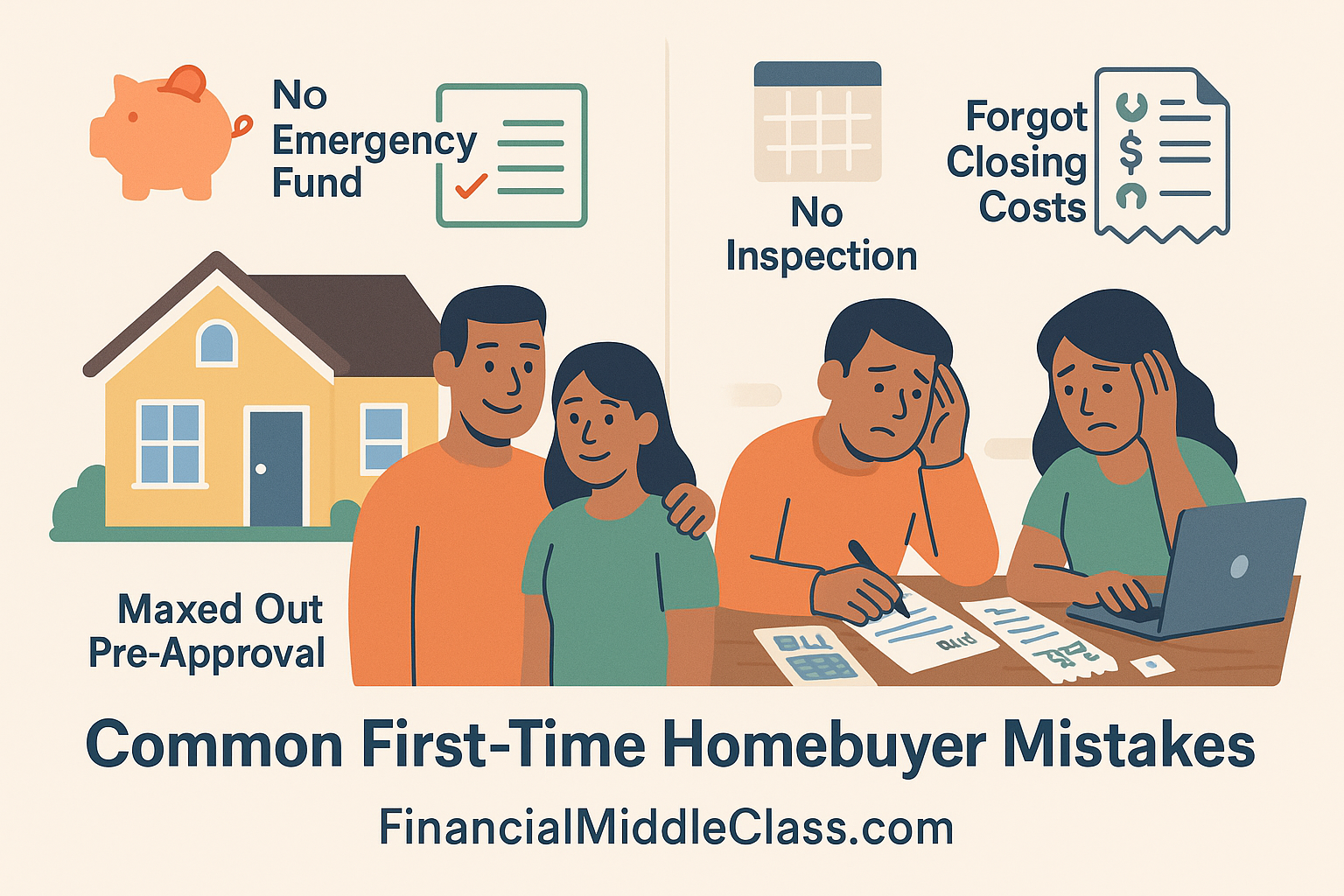

Common First-Time Homebuyer Mistakes That Quietly Wreck Your Budget

Who this guide is for:

Buying your first home is supposed to feel like a win. Instead, too many first-time buyers end up feeling like they signed up for a second job: keeping the house afloat.

The problem usually isn’t one huge bad decision. It’s five or six quiet mistakes that stack on top of each other: underestimating closing costs, draining your savings for the down payment, ignoring maintenance, buying too much house, and trusting the lender’s number more than your own budget.

Most of these mistakes are avoidable if you slow down, run your own numbers, and accept one truth:

The bank will tell you what you can qualify for. Only you can decide what you can actually afford.

The Two Budgets: Lender Math vs Real Life

First-time homebuyers often walk into a bank or online pre-qualification and treat that approval like a blessing. “We got approved for $475,000!” sounds like free money. What it really means is “a lender is comfortable with this risk if everything goes mostly right.”

There are two budgets you need to think about.

| Budget Type | How Lenders See It | How Your Life Feels It |

|---|---|---|

| Lender Budget | Debt-to-income ratios, credit score, employment history. If you check the boxes, you’re “good.” | Does not care that kids’ activities, groceries, aging parents, or your sanity exist. |

| Real-Life Budget | N/A. Lenders can’t see your actual day-to-day priorities. | Includes food, kids, car repairs, giving, travel, saving for the future, and still breathing at the end of the month. |

The gap between those two is where the most painful first-time homebuyer mistakes live.

First-Time Buyer Budget Stress Test

Use this quick debt-to-income check to see if your planned house payment quietly pushes you into the danger zone.

Housing Ratio (Front-End)

0% of income

Total Debt Ratio (Back-End)

0% of income

Rule-of-thumb targets: ≤ 28% for housing and ≤ 36% for all debt. Above that, you’re flirting with being house poor.

Quiet Mistake #1: Draining Your Savings for the Down Payment

A lot of first-time buyers obsess over one number: avoiding private mortgage insurance (PMI). They’ll empty every account to scrape together 20% down, just so they don’t have to see an extra line item on the mortgage statement.

The math they miss? Saving $150 a month on PMI while leaving themselves with $0 in cash. One unexpected repair, one layoff, one medical bill—and the “smart” down payment suddenly looks very dumb.

| Approach | Short-Term Feel | Long-Term Reality |

|---|---|---|

| Max Down Payment, No Cushion | Payment looks lean. You feel proud you “beat” PMI. | You’re one surprise away from credit card debt or missed payments. |

| Smaller Down Payment, Real Emergency Fund | Slightly higher mortgage payment, maybe with PMI. | You can handle car repairs, medical bills, or income dips without panic. |

Your future self cares more about having 3–6 months of expenses in cash than about impressing anyone with a 20% down payment.

Quiet Mistake #2: Ignoring Closing Costs, Moving Costs, and “Day-One” Repairs

Most first-time buyers obsess over the down payment and the monthly payment. They forget the middle: the pile of one-time costs between “offer accepted” and “finally settled.”

Hidden Homebuying Costs Checklist

Use this checklist while you’re still shopping so the first week in your new home doesn’t also become your first week back in credit card debt.

Closing Table

- Lender fees & points

- Title insurance & recording fees

- Prepaid taxes and insurance

- Escrow reserves

Moving Week

- Movers or truck rental

- Utility deposits & overlap rent

- New locks / re-keying

- Basic tools & cleaning supplies

First 90 Days

- Repairs from inspection report

- Furniture you truly need (not a full makeover)

- Emergency maintenance (AC, water heater, roof leaks)

A good rule of thumb: budget at least 2–5% of the purchase price for closing and immediate move-in costs. If you can’t do that without tapping credit, you’re not ready yet. That’s not failure; that’s protection.

Quiet Mistake #3: Skipping the Inspection or Treating It as a Formality

Inspection day isn’t a box to check so your real estate agent can keep the deal moving. It’s your one realistic chance to see the house for what it actually is, not the cleaned-up version from the listing photos.

| Approach | Short-Term Outcome | Long-Term Risk |

|---|---|---|

| Waive or rush the inspection | Offer looks stronger; deal closes fast. | You own surprises: foundation issues, roof near end of life, old plumbing, mold. |

| Slow down, read the report | Maybe you lose one “perfect” house. | You avoid a six-figure headache that wrecks your finances. |

The inspector is not trying to ruin your dream. They’re trying to keep your dream from turning into a second mortgage worth of repairs.

Quiet Mistake #4: Buying More House Than Your Life Can Carry

This is the quiet classic: the lender says “you’re approved up to $550,000,” so you shop at $550,000. You ignore the fact that your actual budget was probably closer to $425,000 if you still want vacations, retirement, daycare, and functioning cars.

| Scenario | Lender-Approved Maximum | Realistic Middle-Class Budget |

|---|---|---|

| Monthly payment | Uses 35–40% of your gross income. | Aims closer to 25–28% of gross income. |

| Lifestyle impact | House looks great; everything else feels tight. | House is good; life still has room to breathe. |

| Risk if things go wrong | One income hit or major repair can trigger a spiral. | You have space to absorb shocks without panic. |

When in doubt, buy the cheaper house and keep the better life.

Quiet Mistake #5: Underestimating Maintenance and “Owning Stuff” Costs

Renters are used to calling maintenance when something breaks. Homeowners are maintenance. That’s not just the big-ticket items (roof, HVAC); it’s the constant drip of smaller things: lawn care, filters, paint, caulk, gutters, appliances aging out.

Annual Maintenance Cost Estimator

A simple rule of thumb is to set aside 1–3% of your home’s value each year for maintenance and repairs. Use this to get a ballpark.

Estimated annual maintenance: $0

Suggested monthly set-aside: $0

If you don’t build this into your budget upfront, those “little” costs end up on credit cards. And that’s how a perfectly reasonable house turns into a slow-motion debt trap.

Quiet Mistake #6: Letting New Debt Creep In Before (or Right After) Closing

Another silent killer: furniture and lifestyle creep. You close on the house and immediately finance a new sofa, TV, lawn tractor, and car to “match the neighborhood.” Or worse, you do it after you get pre-approved but before closing, and suddenly the lender is nervous.

Until you close, the lender is still checking your credit, your job, and your bank balances. Big purchases, new debt, or sudden cash transfers can wreck the deal at the finish line.

After you close, those same decisions quietly squeeze every dollar of margin your budget had left.

Next Steps: Buy the House, Keep Your Life

Buying a home is not about winning some perceived race with your peers. It’s about building a life that can survive surprises.

Here’s a simple way to walk forward:

- Run your numbers through the Budget Stress Test and maintenance estimator on this page.

- Set a hard line for how much of your income you’ll allow housing to eat.

- Refuse to empty your emergency fund to “win” a house.

- Use the inspection to protect your future, not just the deal.

Then, once the house fits your life on paper, walk in and see if it fits your actual life: commute, community, schools, support system. A mortgage you can barely carry in a neighborhood you don’t like is not a win.

Want to go deeper? Pair this article with:

- How much house you can really afford on a middle-class income

- Creating an emergency fund so your house payment never becomes a crisis

- ARM vs fixed in a mid-6% world: who actually wins?

FAQs: First-Time Homebuyer Mistakes

What is the biggest mistake first-time homebuyers make?

The biggest mistake is treating the lender’s approval as your budget. Lenders focus on whether you can technically make the payment. They don’t know or care about your kids’ activities, travel, giving, or how much stress you can handle. You need a separate, stricter budget that reflects your actual life.

How much should I have saved before buying my first home?

At minimum, you want enough for your down payment, closing and moving costs, plus an emergency fund with at least 3–6 months of essential expenses. If buying the house wipes out your cash, you’re taking on too much risk for a first purchase.

How much should I budget for closing costs?

A common range is 2–5% of the purchase price, depending on your lender, state, and the type of loan. That doesn’t include moving costs or immediate repairs, so build those into your plan separately.

How can I avoid becoming house poor as a first-time buyer?

Keep your total housing costs closer to 25–28% of your gross income, avoid draining your emergency fund, and be honest about future expenses like kids, cars, or career changes. If the only way a house works is by maxing the lender’s number and skipping savings, it doesn’t really work.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...