Spot refund, debt-relief, and “new credit” tax scams fast. Learn the red flags and protect your refund—read before you file.

How global conflict and trade shocks hit middle-class budgets in 2026—prices, jobs, rates. Get the evidence and outlook. Read now.

Humanoid robots are moving into workplaces. Here’s what it means for middle-class jobs—and how to adapt. Read the analysis.

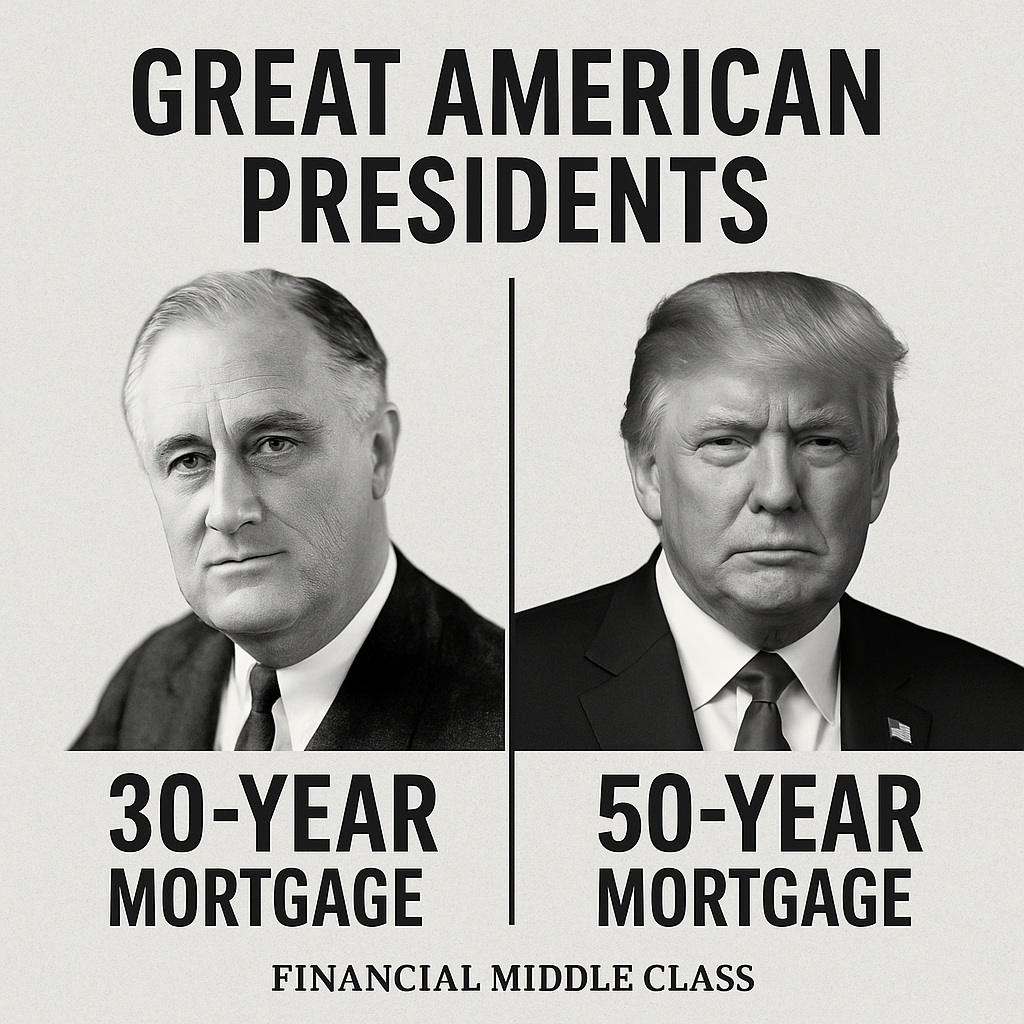

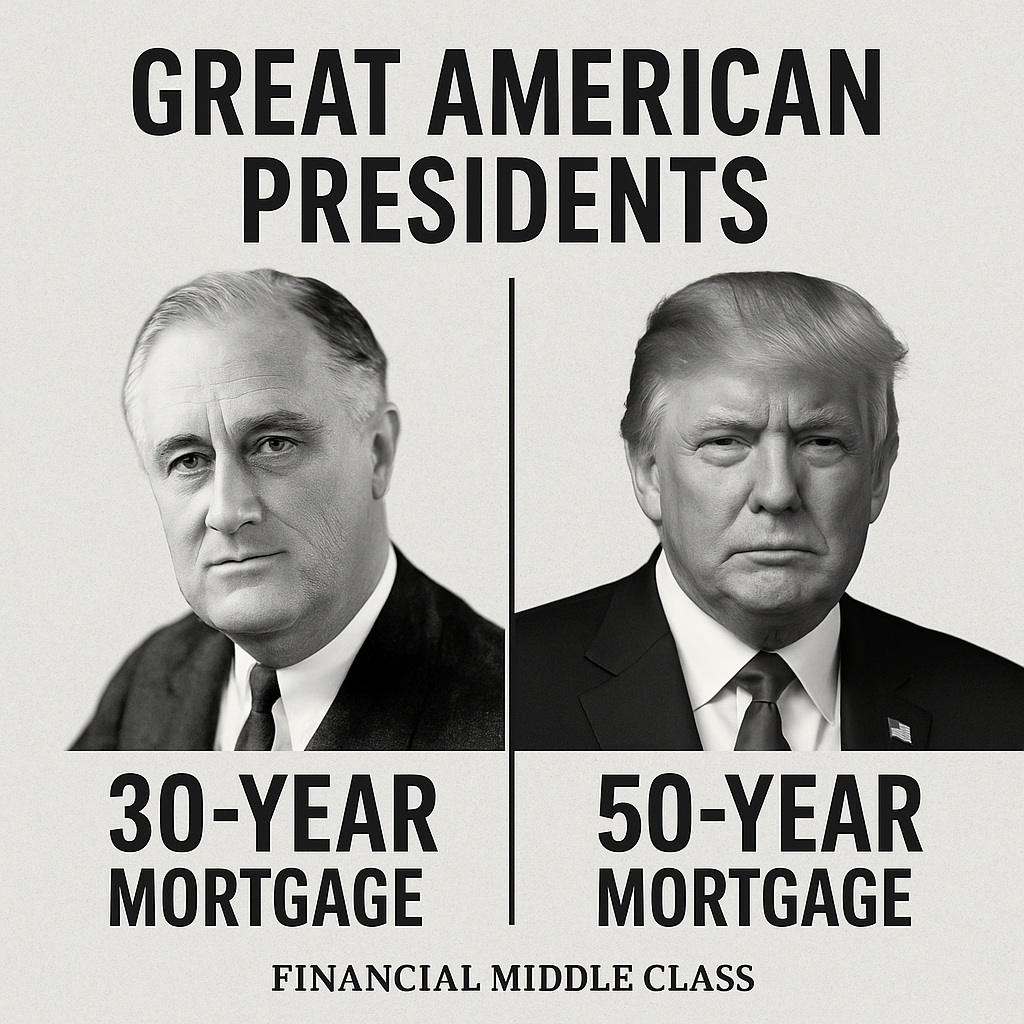

Learn how FHA/VA assumable mortgages work, qualify, and cover the equity gap—so you can snag yesterday’s low rate. Read now.