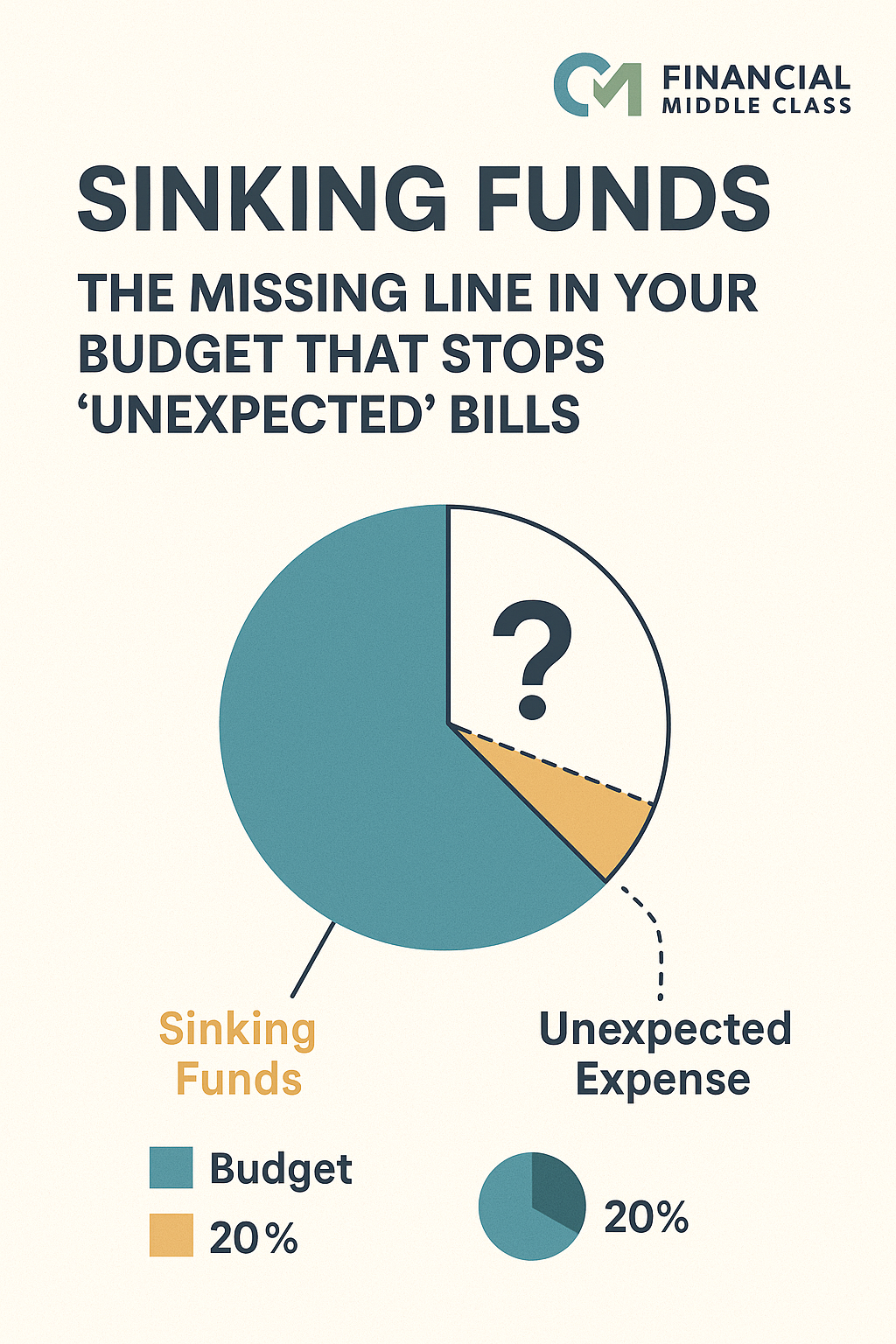

Sinking Funds: The Missing Line in Your Budget That Stops “Unexpected” Bills

By Article Posted by Staff Contributor

The estimated reading time for this post is 418 seconds

You don’t have a car-repair problem.

You don’t have a Christmas problem.

You don’t have a “the kids outgrew their jeans again” problem.

You have a sinking fund problem.

Most of the “emergencies” blowing up middle-class budgets aren’t actually emergencies. Your car will need tires. Christmas will land on December 25. The school will send the email about picture day, field trips, and spirit shirts right on schedule.

Yet every year, Bankrate finds that nearly 60% of Americans still can’t cover a $1,000 surprise bill from savings. So we act shocked, swipe the card, and blame bad luck.

Let’s fix that. Sinking funds are the missing line in your budget that turn “I didn’t see that coming” into “Of course I planned for that.”

What a Sinking Fund Actually Is (In Plain English)

A sinking fund is just this:

Money you set aside on purpose, in advance, every month for an expense you know is coming later.

Personal finance folks love to complicate this, but it’s simple. You’re breaking a big bill into bite-size pieces:

- New tires

- Holiday gifts

- Back-to-school clothes

- Annual car insurance premium

- Summer camp

- Vet visits

Every month, you move a small, specific amount into a separate bucket. When the bill hits, the cash is already waiting. You don’t wreck the month, and you don’t reach for the card.

Ramsey Solutions describes sinking funds as money saved monthly for expenses you can’t or don’t want to pay in a single month—like vacations, Christmas, weddings, or vet bills. Empower gives example categories like transportation, medical care, birthdays, holidays, and more.

The point isn’t the label. The point is intent.

Sinking Fund vs. Emergency Fund: Know the Difference

Here’s where people get tripped up: they’re trying to make one savings account do two jobs.

- Sinking funds are for expected but irregular costs.

- Christmas, car repairs, school clothes, travel.

- Christmas, car repairs, school clothes, travel.

- Emergency funds are for true emergencies.

- Job loss, medical crisis, the transmission dying when you’re already behind.

- Job loss, medical crisis, the transmission dying when you’re already behind.

If it happens every year or every few years, it’s not an emergency. It’s just badly scheduled cash flow.

Think of it this way:

- Sinking funds are how you respect your future self.

- The emergency fund is how you protect your future self.

You need both—one keeps you from sabotaging the month, the other keeps you from bankruptcy when life hits you hard. Budget educators make the same distinction: sinking funds are “for expected expenses that don’t happen every month,” while the emergency fund is reserved for the true curveballs.

The Big Three: Car Repairs, Holidays, School Clothes

You can create 20 different sinking funds if you want. But three categories cause outsized chaos for the middle class:

- Car repairs and maintenance

- Oil changes, tires, brakes, surprise “check engine” visits.

- Cars are mechanical. Mechanical things break. Nothing about that is unexpected.

- Oil changes, tires, brakes, surprise “check engine” visits.

- Holidays and gifts

- You know who you’re buying for. You know roughly what you’ll spend.

- You also know you’re more generous in November and December than in June.

- You know who you’re buying for. You know roughly what you’ll spend.

- School clothes and kid expenses

- New shoes, bigger jeans, backpacks, sports fees, yearbooks, clubs.

- Kids don’t care about your budget categories. They care that their shoes fit.

- New shoes, bigger jeans, backpacks, sports fees, yearbooks, clubs.

If you start with only these three sinking funds, you’ve already prevented half the “budget emergencies” that show up in coaching sessions.

How to Build Sinking Funds Without Blowing Up Your Budget

Now to the question you really care about:

“Where am I supposed to find the money for all this?”

You don’t build sinking funds by inventing new money. You build them by redirecting money you were already spending badly—usually inside your so-called “wants.”

Let’s walk the math.

Step 1: List your “irregular but expected” bills

Start with the big three, then add what applies:

- Car repairs & maintenance

- Holidays and gifts

- School clothes / kids

- Travel

- Annual insurance premiums

- Professional dues / licenses

- Home maintenance (if you own)

Grab a rough yearly number for each. Don’t obsess. If you spent $900 on Christmas last year, call it $1,000. If the mechanic told you “You’ll need tires next year,” and that’s $800, use that.

Step 2: Turn yearly into monthly

Now divide by 12.

Example Sinking Fund Plan

| Category | Estimated Yearly Cost | Monthly Sinking Fund |

|---|---|---|

| Car repairs & maintenance | $1,200 | $100 |

| Holidays & gifts | $1,000 | $84 (round to $85) |

| School clothes & kids | $600 | $50 |

| Travel | $1,200 | $100 |

Total monthly sinking funds: $335

That’s $335 you move on purpose every month into dedicated buckets. Those buckets can be:

- Separate savings accounts nicknamed “Car,” “Christmas,” “Kids,” “Travel,” or

- Digital envelopes inside your budgeting app, or

- Old-school cash envelopes if that works better for you.

Step 3: Carve it out of the 30% “Wants”

Here’s where your angle comes in.

The classic 50/30/20 rule—popularized by Elizabeth Warren—says:

- 50% of take-home → Needs

- 30% → Wants

- 20% → Savings / Debt payoff

Most people treat the 30% wants bucket like a free-for-all: restaurants, streaming, random Amazon purchases, “I work hard, I deserve this.”

That’s where we’re stealing from.

You don’t gut your retirement or emergency fund to start sinking funds. You reassign part of your “fun money” to future you.

If your take-home is $5,000 a month:

- 30% wants = $1,500

- From that $1,500, you carve out $335 for sinking funds (from our example).

- That leaves $1,165 for pure “today” wants.

You didn’t increase your total spending. You didn’t starve your savings rate. You simply admitted that Christmas, car repairs, and school clothes are real wants that deserve a line item instead of a panic.

Side-by-Side: Life Without Sinking Funds vs. With Them

Here’s what actually changes.

| Situation | No Sinking Funds | With Sinking Funds |

|---|---|---|

| Car needs $800 of work | Throw it on the card, minimum payment rises, you feel poor and behind. | Pull $600 from Car fund, $200 from general savings; month is annoying but controlled. |

| December shopping | Swipe until the trunk is full, deal with it in January. | Spend what’s in the Holiday fund; if it feels tight, you adjust gift expectations before the bill hits. |

| Back-to-school | Chaos at the mall, “We’ll figure it out.” | Kids get what they need from the Kids fund; no guilt, no debt spiral. |

Same income. Same car. Same kids.

Different plan.

Where to Park Your Sinking Funds (And What to Avoid)

You don’t need a fancy product. You do need simple separation.

Decent options:

- Multiple savings accounts at your bank or credit union, each nicknamed by goal.

- Digital envelopes in your budgeting app, tied to one main savings account.

- Cash envelopes if physical money helps you behave.

What I don’t love:

- Hiding sinking funds in the same checking account you swipe from every day.

- Dumping everything into a generic “savings” bucket and guessing what belongs to what.

- Investing your sinking funds in something volatile—these are short-term dollars.

The whole point is clarity: “This $85 is for Christmas, not Uber Eats.”

What If There’s Not Enough Left to Fund Them?

Then your budget is telling you the truth you’ve been dodging.

If you genuinely don’t have room to carve out sinking funds from the 30% wants bucket, one of three things is happening:

- Your needs (especially housing) are eating more than 50% of your take-home.

- Your “wants” have quietly become needs in your mind (subscriptions, habits, upgrades).

- Your income is too low for the life you’re trying to finance.

You don’t fix that overnight. But you do acknowledge it.

Start small:

- Pick one sinking fund—usually car repairs or holidays.

- Fund it with $25–$50 a month while you work on dialing back wants or boosting income.

- As raises or side-money show up, grow the list.

Progress beats perfection. A $300 holiday fund is better than “I’ll figure it out on the card.”

Bottom Line: Put Your Future Bills on the Payroll

Sinking funds are not fancy. They’re not Instagram-pretty by default. But they are the difference between:

- “How did this happen again?” and

- “Yeah, I’ve got it covered.”

The Financial Middle Class lives in the space between surviving and thriving. In that space, “unexpected” bills are often just unpaid, predictable bills.

So add the missing line to your budget. Name your top three sinking funds. Slice them out of the 30% wants bucket. Put your future car repairs, holidays, and school clothes on the payroll.

You can’t control when the mechanic calls. You can control whether the call wrecks your month.

RELATED ARTICLES

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

Credit Cards vs. BNPL: Which One Actually Works for the American Middle Class?

Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use this 60-second framework—read now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The Affordability Pivot: Can Trump’s New Promises Actually Lower the Middle-Class Bill?

Will Trump’s affordability proposals lower your bills—or backfire? Housing, rates, tariffs, gas, credit cards—explained. Read now.

By Article Posted by Staff Contributor

Business / Jan 13, 2026

Starting a Nonprofit Is Easy. Starting the Right Nonprofit Is the Hard Part.

The estimated reading time for this post is 880 seconds Last updatedJanuary 13, 2026 — Updated for IRS e-filing pathways (Pay.gov), the 501(c)(4) notice requirement, and...

By Article Posted by Staff Contributor

American Middle Class / Jan 12, 2026

America’s 25 Fastest-Growing Jobs—and the part nobody tells you

BLS lists 25 fast-growing jobs for 2024–2034. Learn what it means, avoid traps, and pick a lane that fits your life—read now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and...

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what...

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and...