Rising Mortgage Rates Send Shivers Through the Housing Market

In a stark and unrelenting turn of events, the United States housing market is facing a tumultuous time as mortgage rates soar to levels not seen in over two decades. Mortgage demand has dropped to a 27-year low as home-purchase applications plummet.

According to recent data from Freddie Mac, mortgage rates have reached their highest point in 22 years, sounding alarm bells for homeowners and prospective buyers across the nation.

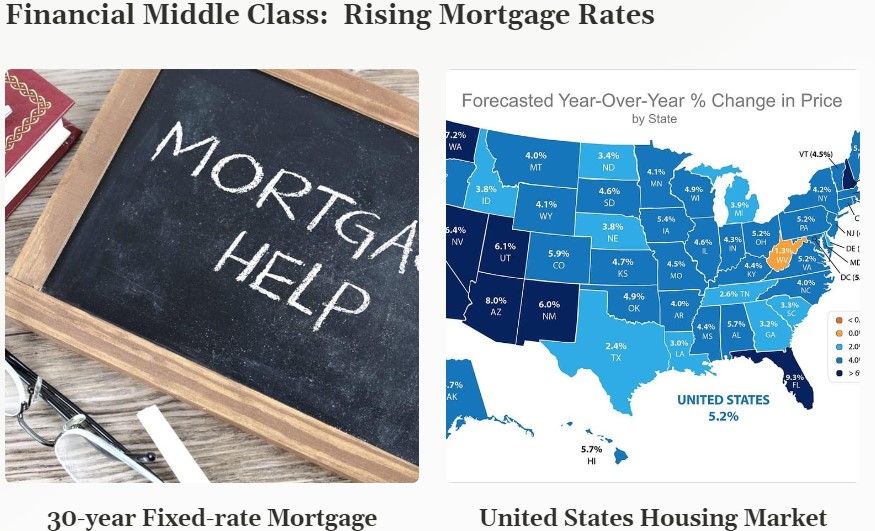

As of the week ending on Thursday, the 30-year fixed-rate mortgage has surged to an alarming 7.55%, marking a significant jump from three weeks ago when it was below 7%. This sharp increase has sent ripples of concern throughout the real estate industry and the broader U.S. economy.

The Federal Reserve’s Aggressive Moves

The driving force behind this abrupt surge in mortgage rates lies in the Federal Reserve’s aggressive stance on interest rates.

In an attempt to combat inflation and rein in an overheating economy, the Fed has embarked on a relentless campaign of interest rate hikes. These hikes, while intended to secure the economic future, are already having a palpable impact on borrowers.

Higher interest rates have a domino effect, impacting an array of financial products, including car loans, credit card debt, and, most notably, mortgages.

For millions of Americans, this means higher monthly mortgage payments and increased costs of borrowing, putting pressure on household budgets and discretionary spending.

The surge in housing costs, exacerbated by these elevated interest rates, has notably contributed to a slowdown in housing demand.

However, the primary culprit behind the sluggish housing market is a dire lack of housing supply. As aspiring homeowners grapple with rising mortgage costs, their dreams of owning a home become ever more elusive.

Is Recession Looming?

Despite these ominous signs, the United States economy has not yet entered the dreaded territory of a recession.

Recent government data revisions indicate that the gross domestic product (GDP) managed to eke out a 2% annualized growth rate over a recent three-month period. This data suggests that the economy is still afloat, albeit facing headwinds that could potentially turn into a storm.

The future trajectory of mortgage costs remains uncertain, hinging on the Federal Reserve’s continued decisions regarding interest rates.

The next rate decision is expected in mid-September, and all eyes are on the central bank as it navigates the delicate balance between controlling inflation and avoiding economic turbulence.

Final Thoughts

The United States is at a crossroads, grappling with surging mortgage rates and their far-reaching implications. While the economy has not yet plunged into a recession, the path forward is shrouded in uncertainty.

Homeowners, potential buyers, and investors alike are left to watch and wait, hoping for a favorable twist in this unfolding economic drama.

As we move closer to the pivotal September rate decision by the Federal Reserve, one thing remains clear: the nation’s financial landscape is rapidly evolving, and its effects will be felt far and wide, from Wall Street to Main Street.